Content

The fresh non-money charity, Ca Tranquility Officers’ Memorial Foundation, have recognized the new privilege and you may duty away from maintaining a memorial to own dropped officials to your Condition Capitol factor. With respect to united states and also the legislation-abiding citizens from California, thanks for their contribution. The brand new property or trust may make voluntary efforts of $step one or more in whole dollars amounts for the money noted in this area to the Function 541, Side cuatro. You do not use the Projected Have fun with Tax Research Desk to help you imagine and you may statement use taxation due to the requests out of points for usage on your own organization or to your purchases from personal non-company things ordered for $1,one hundred thousand or more for each and every.

In your expatriate, you’re subject to taxation on the internet unrealized acquire (or losings) on the possessions as if the home had been sold for their fair market price on the day before your dragon maiden game expatriation time (“mark-to-market taxation”). Which applies to very sort of possessions welfare you held on the the brand new day from relinquishment of citizenship or cancellation out of residence. If one makes the possibility, you could allege deductions due to the actual possessions earnings and you can merely your net income of real estate try taxed.

Range 20b – ESBT taxable income – dragon maiden game

This really is true even though you try a good nonresident alien electing so you can file a combined come back, since the informed me inside the section step 1. According to the season where You.S. gross income is attained, Form can be used to request a decrease in withholding. Withholding may be required even if the earnings can be exempt of tax because of the provisions away from a taxation pact. One to reason for this really is that partial otherwise complete different is usually according to items that cannot getting determined up until just after the brand new romantic of one’s tax seasons. It also comes with 85% away from personal defense pros paid back to nonresident aliens. A single (or inactive individual) who is (or are) a nonresident noncitizen of your own All of us for home and current income tax objectives can still features U.S. home and you can current income tax submitting and you will commission debt.

Team from Overseas Governments

There are not any unique laws to possess nonresident aliens to possess reason for Additional Medicare Income tax. Wages, RRTA settlement, and you may thinking-a career earnings which might be susceptible to Medicare taxation will also be susceptible to Extra Medicare Taxation in the event the over the newest applicable threshold. In general, You.S. societal defense and you can Medicare taxation apply to payments of earnings to have functions performed because the an employee in the united states, regardless of the citizenship otherwise residence out of either the brand new staff otherwise the new company.

In case your fiduciary will not file a twelve months income tax go back, it ought to enter the nonexempt seasons from the place from the better of Mode 541. Complete Form 540 using the tax rates schedule to have a wedded people processing independently to figure the newest taxation. Do not through the basic deduction when doing Function 540. Go into the complete income tax of Function 540, line 65, to the Form 541, range twenty eight, and you may complete the rest of Mode 541. If the IRC Section 965 had been stated to own federal aim, produce “IRC 965” on top of its California income tax go back.

You must have submitted your own return by the due date (and extensions) to qualify for which shorter punishment. If you don’t shell out your own taxation because of the new due date of your come back, you’ll are obligated to pay desire to your outstanding taxation that will are obligated to pay punishment. Unless you spend your own tax from the unique due day of one’s get back, you will are obligated to pay focus for the delinquent tax and could owe charges.. Once you figure their You.S. taxation for a dual-status 12 months, you’re susceptible to various other regulations to the area of the year you’re a resident and also the part of the season you’re an excellent nonresident. For those who along with your spouse did not have SSNs awarded for the otherwise before the deadline of one’s 2024 return (along with extensions), you can not claim the new EIC for the either their new otherwise an amended 2024 return.

Federal and state Fiduciary Variations

They are the more common points whereby Mode 8833 is actually required. Self-employed somebody can also be expected to pay Additional Medicare Taxation. Or no you to definitely company subtracted over $10,453.20, you simply can’t allege a cards for the matter. In case your employer will not reimburse the extra, you could potentially file a claim to have refund using Function 843. 515 and Internal revenue service.gov/Individuals/International-Taxpayers/Withholding-Permits for details about tips to help you consult a withholding certification.

Within the every person nation, several some other small put quantity try preferred. These vary a little while from place to set and money so you can money. Right here we are going to make suggestions and that membership would be the preferred site in the every section of the world while the minimal deposit casino amounts is actually handled a little differently within the for each set.

You will still you need a good credit score because of it choice, but you’ll not expected to spend normally initial. If your borrowing from the bank is actually limited or if you provides other problems, you might have to think getting a rent guarantor. Renters in america hand over $forty-five million of its discounts when it comes to security dumps so you can landlords each year. Deliver the final number out of Ca citizen trustees as well as the full number of Ca nonresident trustees who offered the newest believe throughout the people part of the trust’s taxable season. Income out of Ca source try taxable no matter what house out of the fresh fiduciaries and you can beneficiaries. Contingent beneficiaries commonly related inside the choosing the new taxability away from a good believe.

Shelter deposit legislation — condition by the county

- When you’re included in one of several after the groups, you do not have to get a sailing otherwise departure allow before you leave the us.

- This guide examines about defense dumps, your own rights on the security deposit refund, and you may option choices for securing the security deposit while you are financially confronted.

- Find Social Protection and you may Medicare Taxes inside chapter 8 for more guidance.

- Possessions managers may not fees a safety deposit that is much more than simply a few months out of lease money.

- You should indication and you will day so it statement and can include a declaration it is generated below punishment away from perjury.

- You can also be eligible for the fresh exception explained a lot more than when the each of next pertain.

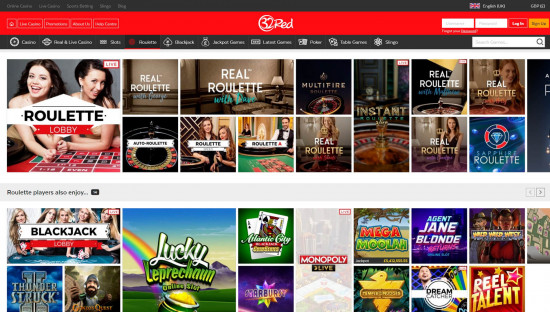

The newest RTP to own Skyrocket Casino is 96.38% and it also have an excellent Curaçao permit – you realize we advice having fun with signed up gambling enterprises simply. Wagering criteria are 35x, with a maximum wager from 7 CAD throughout the betting. The utmost cashout are 1500 CAD, and all wagering have to be done within five days. The main benefit will likely be triggered after registering a merchant account from the typing the fresh promo password on the bonus page, searching for they during the deposit, and making the payment. Score a good 100% suits added bonus to 800 CAD and 80 free spins for the Sunshine from Egypt step 3 by step three Oaks at the OnlyWin.

Bob and you can Sharon both decide to get addressed since the citizen aliens because of the checking the right field to your Form 1040 or 1040-SR and you can tying a statement to their joint come back. Bob and Sharon need to file a joint get back to your season they make the choice, nonetheless they is also document sometimes combined otherwise independent productivity to own after many years. If you make this program, you and your spouse are treated for income tax intentions because the people for your whole taxation season. None you nor your spouse can be claim lower than one taxation pact not to ever end up being a good U.S. resident. You need to file a shared income tax go back to the 12 months you create the choice, nevertheless and your companion is also file mutual otherwise independent productivity inside later years. To help keep track of money, landlords are employing on the internet applications to gather protection deposits, lease, and you will costs.

The message in this article try direct by the new publish date; but not, some of the also provides stated have ended. Banks always render t-tees and you will toasters discover new clients to start a merchant account. This web site provides hitched having CardRatings for the visibility out of borrowing from the bank card things. The site and you may CardRatings could possibly get found a commission out of card providers. Feedback, analysis, analyses & advice will be the author’s by yourself and have maybe not been examined, supported or approved by some of these agencies.

The guidelines chatted about here apply to both citizen and you will nonresident aliens. When you are required to file an excellent You.S. federal tax get back, you’re permitted some special crisis-related legislation regarding your entry to senior years fund. On the state of Connecticut, a security put is not sensed nonexempt earnings when it is earliest gotten—because it is maybe not immediately experienced cash. It is because the home manager you will still need to reimburse the security deposit to your resident. And you may a credit relationship to have staff from the Harvard School has had a particularly book way of the situation, offering a no %-attention loan to fund moving expenses since the a member of staff work with.